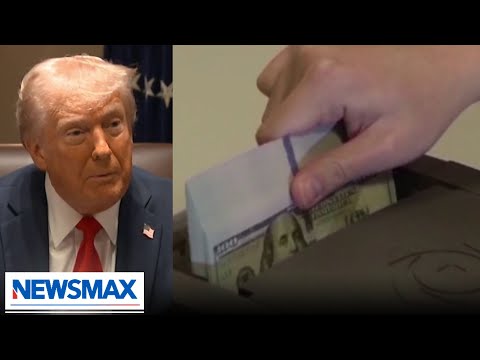

In recent political maneuvers, significant strides towards budget balancing have emerged in Washington D.C. As discussions around the nation’s monetary management intensified, a pivotal cabinet meeting led by Trump showcased the newly passed financial measures that could potentially lighten the financial burden on everyday Americans. With House Republicans navigating a slim majority, they managed to pass a bill that eliminates certain taxes which many consider a win for the average citizen.

The bill that was passed last night was a cornerstone piece of legislation aimed at achieving a balanced budget within a relatively short timeframe—potentially as soon as next year. This plan notably includes no taxes on tips, overtime, or Social Security benefits, which is particularly promising news for those working in service industries or relying on retirement benefits. However, the partisan divide in this matter was quite clear, as not a single Democrat supported the bill. It raises questions about collaboration across the aisle, especially when the focus should ideally be on the American people’s welfare.

The financial experts were brought in to discuss the implications of the recently passed legislative measures. Notable among them was an economist from the Heritage Foundation who highlighted the precautionary nature of the cuts as compared to previous Democratic measures that were less favorable for the financial resources allocated to Medicaid. Unlike past bills under Democratic leadership, this current measure was designed with a promise of permanent tax reductions, aimed at reassuring businesses and investors about future economic conditions and encouraging growth through enhanced investment.

As the conversation shifted, it became clear that there is a stark contrast between the priorities set by the two parties: Republicans appear focused on fostering a stable financial future, while Democrats seem content with engaging in fearmongering. Critics have pointed out the irony of Democratic leaders overlooking the positive aspects of this bill while focusing on unfounded apprehensions about supposed cuts to Medicare—a program that is surprisingly absent from these discussions. The intention behind the Republican bill is not to dismantle essential services but rather to streamline government operations and cut down on inefficiencies.

With the groundwork laid for a balanced budget, it seems the winds of change may be blowing favorably for Americans seeking relief from high taxes and bureaucratic obstacles. This is a significant step forward, although it is essential to remain vigilant about the hurdles ahead as the measure moves on to the Senate. Effective governance calls for clear communication, and if Republicans can ensure a robust plan to support their budgetary ambitions, it is likely that Americans will start to feel the positive effects in their wallets sooner rather than later.

As the dust settles from the recent cabinet meeting, many await to see how these proposals will function in practice. One thing is for sure: the conversation surrounding the nation’s budget and finances is far from over, and Republicans are determined to push through their plans, even if they’re met with skepticism from the other side of the aisle. As they say, “You can’t please everyone,” but if this bill manages to make a tangible difference in everyday lives, perhaps the GOP will find they can win back some favor with the American public after all.