In a twist that could send shockwaves through the energy market, analysts at Goldman Sachs are warning that oil prices could soar to multi-year highs if Iran retaliates against recent US airstrikes. This predicament comes as the ongoing tussle between the US and Iran intensifies, with potential repercussions that may echo all the way to your next fill-up at the gas pump. Grab your coffee and prepare for some serious market talk!

On June 22nd, the US targeted three Iranian nuclear sites, officially igniting America’s role in the Israel-Iran conflict. In response, Iranian state media announced the possibility of closing the Strait of Hormuz, a pinch point for about 20% of the world’s oil. Just imagine, that’s like a traffic jam of oil tankers trying to get through a busy highway! The US Department of Energy estimates that in 2024, this crucial waterway will be even more essential for global oil distribution. If Iran acts on its threats, Goldman predicts that oil flows could decline by 50% for at least a month—a scenario that sends shivers down the spine of any economist watching inflation tick upward.

Oil prices were already on the rise and were sitting at around $77 per barrel on June 24th. If Iran does follow through with its threat, prices could shoot up to over $110 per barrel, marking the highest levels seen since July 2022. This situation is definitely not music to the ears of consumers already grappling with inflation issues. As JP Morgan economists point out, if Brent prices remain over $75 for an extended period, it could lead to a 2% hike in the global consumer price index—basically, that means everything from groceries to gas could end up costing more.

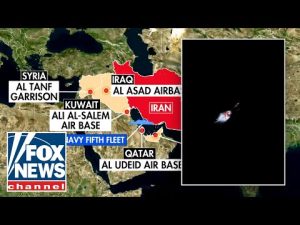

Iran holds the title of the ninth largest oil producer in the world, and its position on the Strait of Hormuz gives it a significant role in the Middle East’s energy game. This isn’t just about numbers on a chart; it’s about geopolitical tension that could have real consequences for consumers and businesses back home. The stakes are high, and the impact has the potential to reach far beyond just the oil markets. As the US navigates the treacherous waters of international relations and economic recovery, any moves by Iran could set off a ripple effect that makes everyday life more expensive for everyone.

So, what does this all mean for the average American? Well, it means keeping an eye on gas prices and possibly preparing for higher bills in the upcoming months. The markets are notoriously unpredictable, and with the current geopolitical climate, there’s no telling how high those prices could go. As the situation evolves, consumers may want to brace themselves for more than just soaring oil prices; they might find themselves in for a bumpy ride that affects their wallets directly. Time to stock up on some snacks for the road ahead!