The housing market seems to be stuck in a game of tug-of-war, with hopeful homebuyers and owners alike eagerly waiting for a rate cut from the Federal Reserve. However, while a cut might seem like the golden ticket to lower mortgage rates, the reality is a bit more complicated. Even with a rate cut, experts say mortgage rates may not dip below 6%, leaving many in a bit of a quandary.

For the past few years, the housing market has become something of a stalemate. Many potential sellers are hanging onto their homes, clutching their low mortgage rates with a grip tighter than a child holding onto a favorite toy. The fear of jumping into the current market, which features significantly higher rates, keeps them from putting their homes up for sale. As a result, inventory levels are lower than a low-flying kite on a calm day, leaving buyers with limited options.

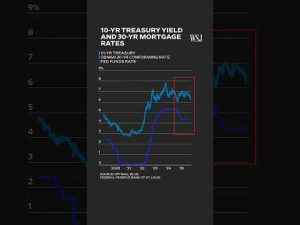

In recent news, mortgage rates have hit an 11th month low, bringing a much-needed glimmer of hope to the weary homebuyer. However, it’s important to note that mortgage rates don’t always follow the Fed’s short-term rates like it’s a devoted puppy on a leash. Instead, they often mirror the 10-year Treasury yield, which is a key player in setting borrowing costs across the economy. Since many buyers hold onto their homes for close to a decade, the 10-year Treasury yield acts as a more reliable compass for where mortgage rates might land.

Throughout the past year, there’s been a peculiar dance between short-term and long-term rates. When the Fed cut short-term rates last fall, many expected mortgage rates to follow suit. However, they rose instead, thanks to rising investor concerns about federal deficits and inflation. It’s like trying to predict the weather when you really should have checked the forecast. The uncertainty surrounding where these rates are headed has kept investors demanding a premium for mortgages, leading to elevated spreads.

While economists are cautiously optimistic, predicting that mortgage rates may gradually drop through the end of the year and into early next year, they largely expect these rates to hover above that ever-elusive 6% mark. Some industry experts are holding onto the hope that rates might even flirt with the high fives by late 2026. But let’s face it—those predicting a dramatic drop in rates have been wrong time and time again, resembling that friend who always insists it will be sunny, only to get caught in a downpour.

So, for those looking to buy a home, it’s crucial to remember that a Fed cut alone does not guarantee lower mortgage rates. If someone is considering buying, they should make sure they can comfortably afford the current rate on their income, without relying on a dream of refinancing down the road. The housing market may be a bit like a roller coaster ride right now, with its ups and downs, twists and turns, but navigating it wisely will help potential buyers steer clear of any stomach-churning surprises.